Charity Financials 101

Mar 26,2016

One of the most important things to consider when evaluating a charity that you may want to donate to is its financial standing. What good is it to donate or volunteer for a charity that means well but cannot effectively achieve its programming goal because it is financially unstable? Assuring the financial stability of a nonprofit organization is a crucial part of the evaluation process.

There are many resources available on the internet to gain information about charities. Guidestar and Charity Navigator are both charity search engines that provide financial profiles of thousands of charities for people to take advantage of.

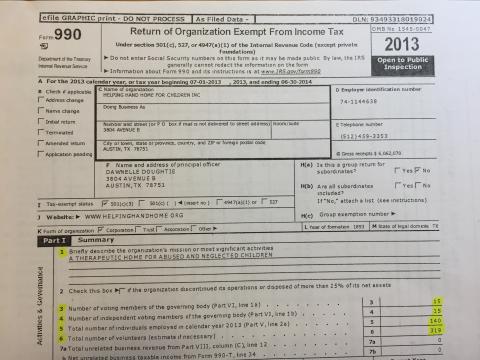

The most valuable source of information that these resources provide is access to a charity’s IRS Form 990. An IRS Form 990 is a document that all 501(c)(3) nonprofit organizations must fill out in order to receive tax exemption benefits from the government as well as to ensure tax deductibility of donations made to them. Although it is not exactly reader friendly, the form provides a great deal of financial information about a charity that is very useful in the evaluation process.

The first page of the IRS Form 990 provides information about the total revenue and expenses of the organization, net revenue, and the governing body of the charity. Lines 3 and 4 provide information about the number of voting members of the governing body and the number of independent voting members in the voting body, respectively. In a good charity, these two numbers will be identical. Below that, in lines 5 and 6, are the number of employees and volunteers that the charity has. Lines 8-12 show sources of income, with line 12 showing the total revenue of the organization. Lines 13-19 show expenses of the organization. Line 15 specifically shows total monetary compensation given to employees. Line 16a is particularly important as it shows how much the charity pays an independent professional fundraising company to fundraise for them. A big number in this section can raise a red flag, depending on the type of charity. Be cautious of this line. Following that is line 18, which shows total expenses of the organization. Of great importance is line 19, which shows the net income of the organization for that fiscal year and for the prior fiscal year. Both years should show a positive number; otherwise that is another red flag against the charity. Inability to remain in the positive hints towards a financially unstable organization.

Page two, which holds part 3 of the IRS Form 990, shows the statement of program service accomplishments. This page is very useful because it shows in detail what the program expenses are going into. The expense description on this page should align with the mission of the organization. If not, this is another red flag as it demonstrates that the charity is not spending its resources on its intended programming.

Part 4 of the form houses several informative questions about the organization. Depending on what you are looking for in your charity, these questions may or may not be relevant to you. However, line 17 is relevant to everyone. Line 17 asks if the organization spent more than $15,000 on a professional fundraiser. Depending on the size and type of organization, an answer of “yes” to this question could be a red flag.

Part 5 of the form deals with the governance and management of the organization. Check lines 1a-b to ensure that the number of voting members in the governing body of the charity match the number of independent voting members in the governing body. These two numbers should be equal. Also check lines 15a-b, which entail the assurance that the process for choosing compensation of officers and key employees of the organization is done fairly. Answers to both questions should be “yes.”

Following that page is part 6 of the document. This part shows the compensation of voting members of the governing body and of other key employees. Keep in mind that none of the voting members should be compensated with any money, so they should all have a 0 under columns d, e, and f. If they are compensated, this is a red flag that the organization is not trustworthy. Only the executive director may be compensated, along with key employees not in the governing body of the organization. Their salaries can be found under columns d, e, and f.

In part 8 under lines 1a-g is information about what kinds of contributions and donations the organization earned as part of its revenue. Line 1h shows the overall total of lines 1a-g. Below this, in line 2, are program service revenue numbers, with the total again at the bottom of the section. Throughout the rest of the page is more information on where exactly the organization is obtaining its revenue. At the very bottom of the page, in line 12, is the total revenue for the organization.

Next in the form is part 9, which covers functional expenses. Column a covers total expenses for each of the following columns. Columns b, c, and d cover program expenses, administrative expenses, and fundraising expenses respectively. At the bottom of the page in line 25 are the totals for all four columns, with the grand total under column a. Overhead costs can be calculated here. Overhead costs are any expenses that are not program expenses, which means any money spent in columns c and d. To calculate overhead costs, simply add the numbers in line 25 and columns c and d. To calculate the percentage that overhead is costing the organization as a whole, divide said total by the grand total. Generally, the percentage should not be above 30%. However, you should consider your personal preference and the type of organization you are evaluating to determine what overhead cost percentage you are comfortable with, while using the 30% rule as a guideline if needed. For example, you may want to excuse a high fundraising cost if the organization relies on fundraising as a significant source of revenue.

At the end of the IRS Form 990 are the schedules, which provide supplemental information to the form. Part 2 of Schedule A under line 1 shows the total amount of revenue in monetary contributions the organization has earned in the last 5 fiscal years. This is very important for the evaluator because it shows if the organization is growing in recognition and thriving.

Lastly, under Schedule G part 2 is the information for fundraising events. Here the evaluator can examine the effectiveness of fundraising within the organization. Columns a-c show important fundraising events in the last fiscal year, with total revenue and expenses for the events being located in lines 3 and 10 respectively. Line 11 is of particular importance because it shows the net income of all the fundraising events in the last year. This number should be positive, otherwise the organization is wasting money on fundraising overhead expenses.

Reviewing financials is a crucial part of the evaluation process when deciding whether or not to donate money to a charity. It should be a part of the evaluation process when a large sum of money is being donated in order to ensure that the money is being used in the most effective way possible.